What is road tax?

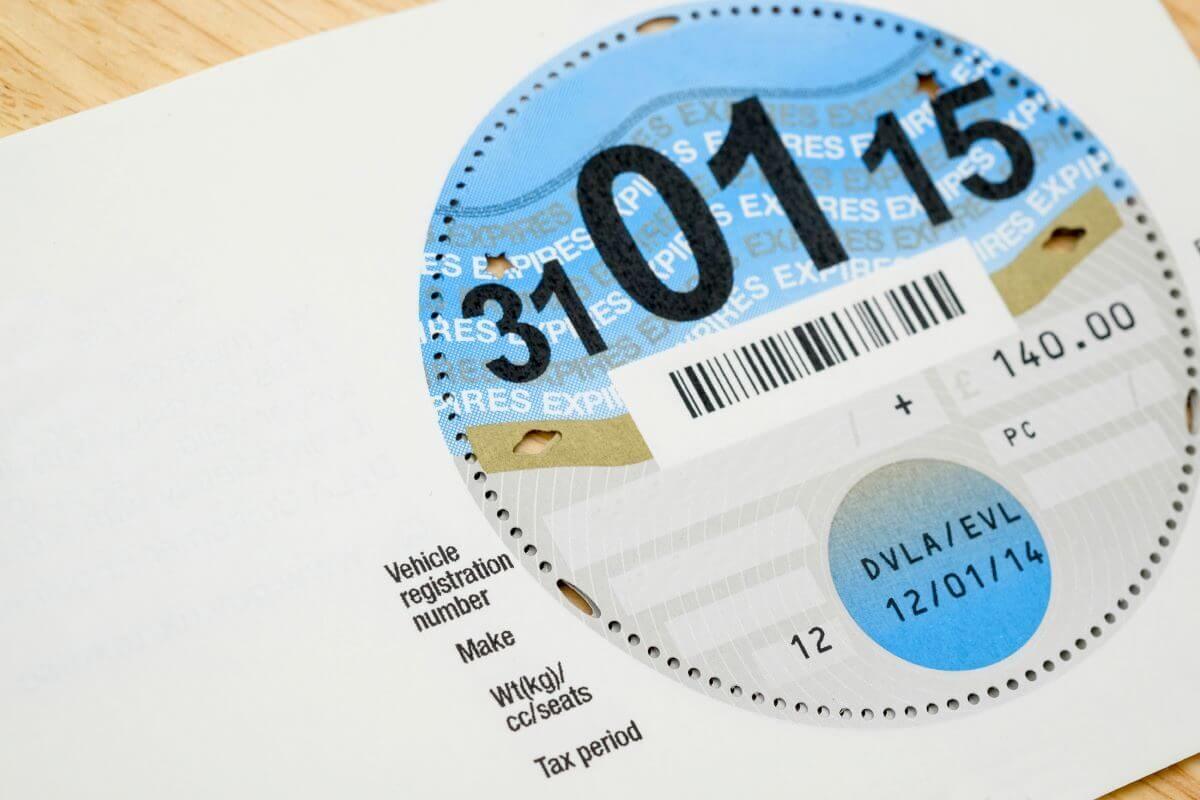

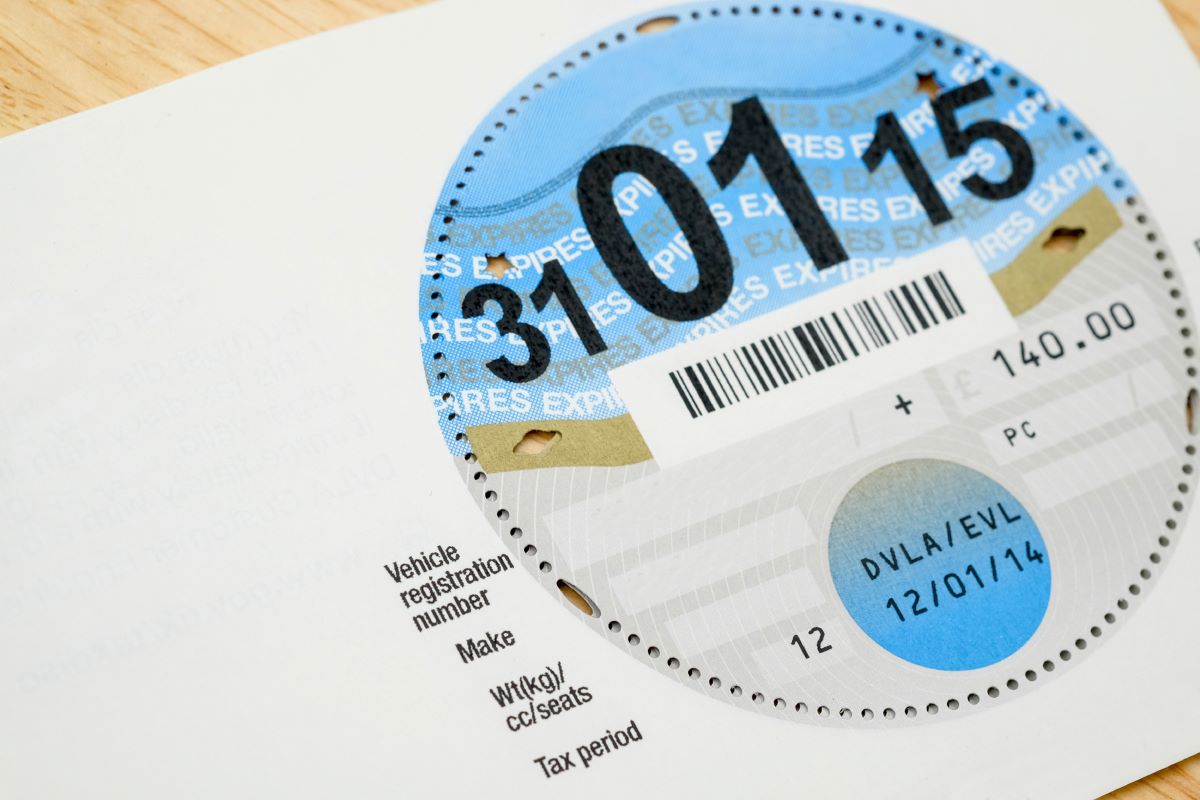

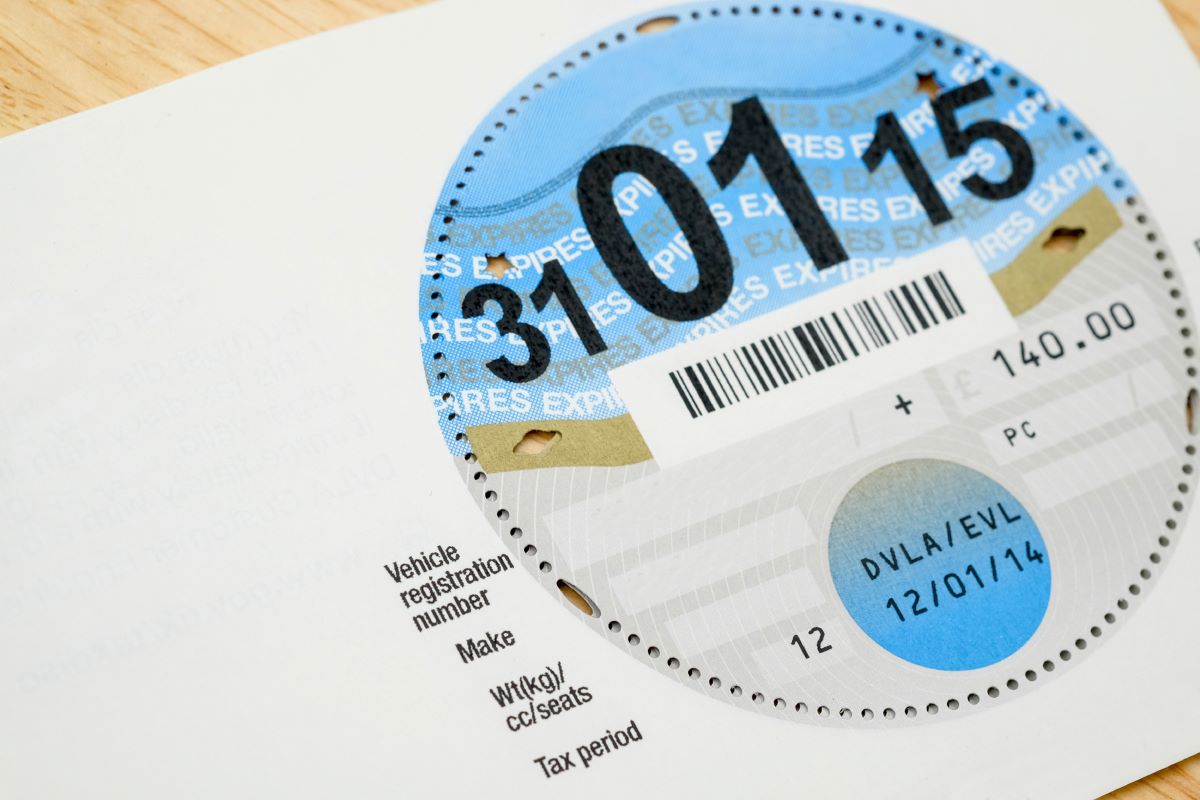

First things first, it’s important to note that car tax, often referred to as vehicle tax, road tax or vehicle excise duty (VED), is something that’s applied to all cars in the UK. Having said that, not all cars are treated equally.

Road tax on electric cars and hybrid cars is typically cheaper than what you’d have to pay for petrol and diesel cars. The reason is that they emit less CO2, and VED is now largely based on a vehicle’s emissions to help the UK meet its net-zero climate targets. A good reason, we’re sure you’ll agree.

So, if you’re wondering if the tax requirement varies from regular cars to electric cars, the short answer is that yes, it does.

Do you need to pay road tax on electric cars?

No. Since April 2020, you don’t have to pay car tax on any zero-emission vehicles, which includes electric cars – they’re completely exempt. This is because EVs don’t produce tailpipe emissions – aka, pollution emitted from the exhaust – which is what VED is currently based around.

It used to be the case that cars costing over £40k would have an additional charge, but this has now been scrapped for all electric vehicles as well. So, currently, you won’t have to pay any road tax if you’re driving an EV.

Remember, though: You still have to register for road tax for your electric car and fill in the documentation – it just won’t cost you anything to do so.

Do you need to pay road tax on hybrid cars?

Wondering if hybrids are exempt from road tax too? No, unfortunately not. If you’re looking to buy a hybrid or plug-in hybrid (PHEVs), you will still need to pay vehicle excise duty like with petrol and diesel cars. However, with lower CO2 emissions comes a lower tax rate, so hybrids can still save you money in road tax. Definitely something worth bearing in mind during your search.

Road tax for hybrid cars registered on or after 1 April 2017

As mentioned, you’ll typically pay less road tax for hybrid cars, but it’s not a simple calculation, as it all depends on how old the car is, as well as its emission levels. Low emission hybrid cars will pay a reduced rate in the first year but will then have to pay increasing amounts after that, usually every six or 12 months.

How is road tax calculated?

The key thing to remember is that for all vehicle types, road tax is initially calculated using your car’s CO2 emissions. The higher the emissions, the higher the tax rate. It’s also split into two payments – the first-year rate, which is based on the emissions, followed by a set standard rate from then on out.

Buying an electric car certainly saves you money on vehicle tax, because you currently don’t have to pay anything for the first year (as it has 0g/km CO2 emissions) or the standard rate afterwards. This is a potentially huge selling point if you’re considering buying an EV. That and the fact it’s an eco-friendly choice and doesn’t rely on petrol.

Either way, you can see how much you’d save in vehicle excise duty in the example tables below:

First-year tax rate (when you register the car)

| CO2 emissions |

Hybrid cars |

Petrol cars and RDE2 standard diesel cars |

| 0g/km |

£0 |

£0 |

| 1-50g/km |

£0 |

£10 |

| 51-75g/km |

£15 |

£25 |

| 76-90g/km |

£105 |

£115 |

| 91-100g/km |

£130 |

£140 |

| 101-110g/km |

£150 |

£160 |

| 111-130g/km |

£170 |

£180 |

| 131-150g/km |

£210 |

£220 |

| 151-170g/km |

£545 |

£555 |

| 171-190g/km |

£885 |

£895 |

| 191-225g/km |

£1,335 |

£1,345 |

| 226-255g/km |

£1,900 |

£1,910 |

| Over 255g/km |

£2,235 |

£2,245 |

A note on fuel duty

Fuel duty is an excise tax applied to the sale of diesel and petrol (not electricity) and is included in the price of the fuel itself. By contrast, charging up your EV battery accrues no fuel duty at all! As you can imagine, fuel duty is a significant source of revenue for HM Treasury. As drivers shift to electric cars and move away from fuel, in the future, it’s likely the government will introduce alternative tax measures to EVs to recover the money lost from fuel tax.

Hybrid car road tax rates

So, how much road tax do you pay on hybrid cars?

Depending on the CO2 emissions, the first year of road tax for hybrids and plug-in hybrids will typically cost drivers anywhere from £0 to around £105. The following years for all hybrids will then be charged at the standard rate of £145 per year.

For example, if you bought a new Toyota Prius hybrid you’d pay £130 for the first year of tax as this model produces 94g/km of CO2 emissions. The following tax payments would be at the standard rate of £145. If you bought the Prius PHEV model, you’d make more tax savings as its CO2 figures are only 28g/km – meaning it’d be free to tax in the first year.

If you want to know more, the gov.uk site provides further handy information on rates, based around a car’s CO2 emissions and fuel type (whether diesel, petrol, or alternative fuel source).

Premium rate road tax

There’s also something known as premium rate road tax. This is when a vehicle has a list price of more than £40,000 (before any discounts are applied). The additional fee is £335 and you pay it from the second year for a total of five years. However, as mentioned, electric vehicles are now exempt from this premium rate, so this only applies to petrol, diesel, and hybrid cars.

What are the tax benefits of owning an electric car in the UK?

Outside of not having to pay VED, there are of course many benefits to owning an electric car, not least that it produces zero daily emissions!

By applying a tax incentive for electric cars, the government is making EVs an even more enticing proposition and encouraging drivers to make the switch. Thanks to their zero CO2 emissions, electric vehicles come with a number of tax incentives. The main benefits include:

1. EV Congestion charge exemptions

All fully-electric cars are exempt from the London Congestion Charge Zone and London’s Ultra Low Emission Zone (ULEZ). If you live in London, this could save you thousands of pounds a year. Take note, though, this will only last until December 25, 2025, when the exemption will be dropped and EVs will be subject to the charges.

2. Lowered national insurance contributions for businesses

When it comes to businesses, employers pay less National Insurance Contributions (NICs) when they provide employees with electric vehicles and low-emission plug-in hybrids compared to petrol and diesel cars. This is because Class 1 NICs for company cars are calculated using official CO2 emissions, and, as we now know, EV’s and hybrids have much lower emission.

3. Capital allowances on electric cars for businesses

When it comes to company car tax on electric cars, businesses can also reclaim the full cost of one electric car as a capital allowance (see: gov.uk’s Capital Allowances page). Even better, a business can claim grants for installing chargers through the Workplace Charging Scheme.

4. VAT

Businesses can also claim VAT on EV’s, but it’s worth noting that VAT is only recoverable on a purchase if it can be proved that the electric car is solely available and used for business purposes. Just be aware that this can be a difficult thing to demonstrate.

Will tax relief on electric cars change in the future?

The all-important question…

Can we be honest? Yes, in all likelihood, it will.

Currently, the tax exemption for electric vehicles is an incentive for us to make the switch to driving electric. It’s part of a drive to lower CO2 emissions to meet net-zero targets – obviously a good thing in the long run!

In the near future though, once enough drivers have made the switch, it’s highly likely that EVs will be taxed. Let’s not forget that a ban on producing purely petrol or diesel engines is currently set for 2030 in the UK, so the government is currently thinking of new ways to reintroduce road tax for all vehicles. This will be to cover the taxation “loss” that would appear as more people move away from petrol and diesel cars. What form this tax would take and when it would come into play are questions currently up for debate.

Before that, though, we’re more likely to see increasingly higher vehicle tax rates on high-emission cars.